PLASMA Use Cases

Discover how PLASMA can transform option strategies for different client needs.

What you can do with PLASMA

PLASMA enables the construction of powerful rules-based options strategies for core equity model portfolios or client-specific concentrated stock positions

Generate consistent income through optimized covered call strategies, helping retirees maintain their lifestyle without depleting principal.

Enhance portfolio returns through strategic option overlays, accelerating wealth accumulation for pre-retirement investors.

Create asymmetric risk-reward profiles where potential rewards exceed capital at risk, ideal for younger investors with longer time horizons.

Implement downside protection strategies that limit maximum potential losses while maintaining exposure to market upside, providing peace of mind for investors.

Create more efficient portfolios that reduce volatility and drawdowns without sacrificing long-term expected returns through strategic option overlays.

PLASMA In Action: Covered Call Writing - currently piloting!

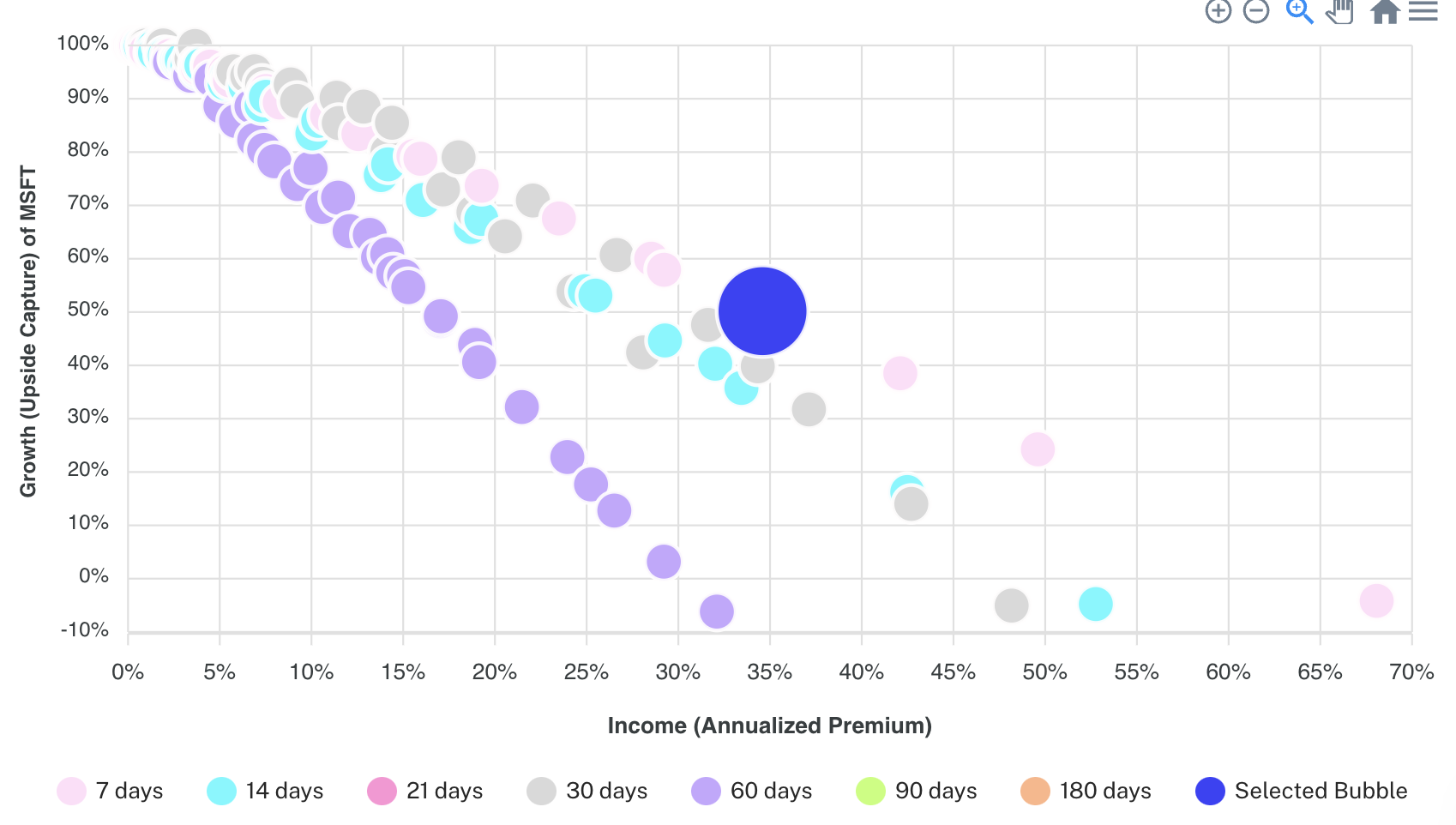

Covered Call Writing involves selling call options on stocks you own, trading-off future stock growth for option income. With 100s if not 1,000s of calls available on most stocks, which do you choose?

Income

Premium received for selling call options

Metric = annualized premium generated

Growth

Capping the stock upside at the call strike

Metric = upside capture of the stock over time

Find The Right Call For You

- •Call option selection (tenor, strike) and sizing relative to the stock ("coverage") can lead to a wide variety of outcomes when it comes to the Income & Growth trade-off

- •It's the long-term performance impact of rolling options that matters – not any 1 trade in particular

- •PLASMA analyzes all liquid call options available & identifies the optimal call option based on your objectives

Optimization Objectives:

Balance Income & Growth (shown)

Maximize Expected Return

Target Risk Score

... build your own optimization objective (historical & real-time metrics available)

Example: Microsoft (MSFT) Covered Call Strategy

Each of the 120 bubbles represents the backtested performance of a unique MSFT Covered Call strategy across a broad range of option tenors (up to 2 months), strikes (up to 15% OTM) & coverage ratios (up to 100%).

Blue circle = "Balanced Income & Growth" MSFT Covered Call strategy (optimized), targeting weekly MSFT call options (2-3% OTM strike, 100% coverage ratio) per backtested performance (12/30/2022–3/21/2025).

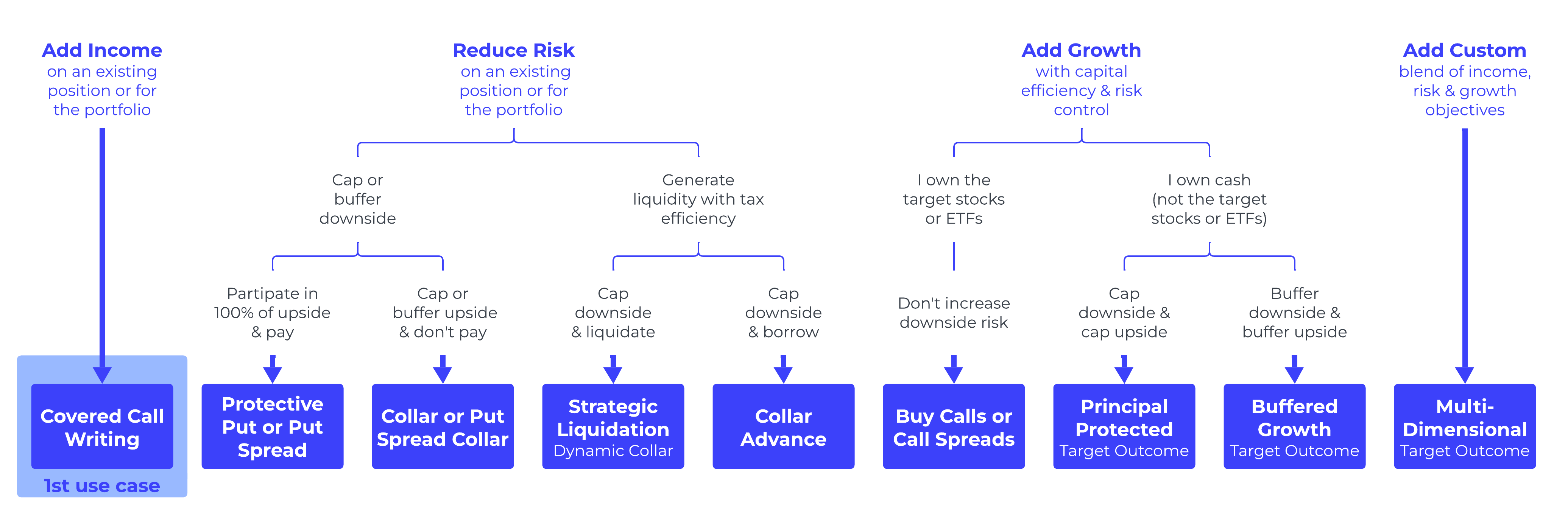

PLASMA Strategy Map

PLASMA supports a wide range of option strategies to meet different investment objectives.

Strategy Progression

Our platform development roadmap follows this strategy map, starting with Covered Call Writing as our first use case. We'll progressively add more sophisticated strategies based on market demand and client feedback.

Current Focus: Covered Call Writing is our initial strategy, with additional strategies planned for future releases. Contact us to discuss your specific strategy needs and how they align with our development roadmap.

Ready to transform how you invest in options for your clients?

We are launching our covered calls pilot program in Q3 2025 and have room for additional participants. Please contact us for more information.

Contact Us Today